What’s inside?

It’s tempting to look at risk and view it as unavoidable, a force majeure if you will, yet unanticipated does not necessarily mean unavoidable or unmitigable. As the world enters this new age of pandemics, the way organizations operate is likely to change fundamentally. These new risks, alongside ever-evolving existing risks, require a change in approach.

The maritime ecosystem will have to digitalize, and they will have to do it together to succeed. Organizations should adopt agile risk management strategies that map the multidimensional facets of risk as they impact their businesses and develop the capabilities needed to meet future challenges successfully.

On March 24th, 2021, we held an exciting webinar, “Maritime Risk: A Multidimensional Approach,” and brought together leading experts from multi-risk disciplines to discuss global changes and their impact on organizations in the maritime ecosystem.

Understanding risk and defining what is risky

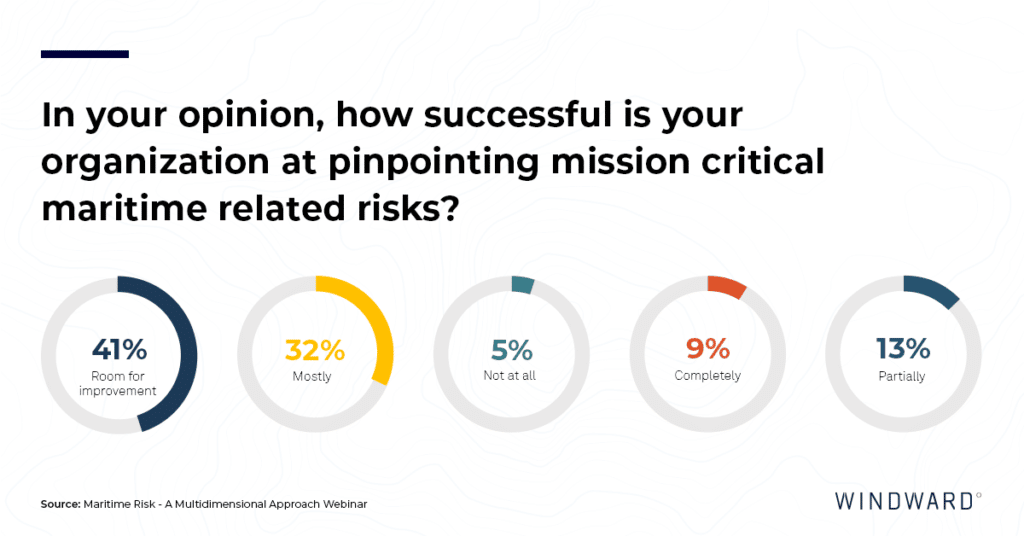

The question of what constitutes risk has changed over the years, and as a result, the way risk is managed must be adapted. A simple question asked by webinar host and Windward V.P. Commercial Ron Crean revealed that most organizations are fairly confident in their ability to pinpoint mission-critical maritime-related risks. However, as retired U.S. coast guard commander and geospatial expert James Valentine noted, the question is, “how does your perception match with what’s a critical risk.”

The maritime ecosystem, as a whole, has the knowledge, capabilities, and technological tools needed to manage expected risks efficiently. The problems arise when risks go beyond the expected and cascade the current systems’ capabilities. When mission-critical risks pose an existential threat to operations, that is when risk management matters.

The recent Suez Canal’s blockage did not have an immediate solution, no matter how risk-prepared organizations thought they were, which led to a global back up of supply chains. This is a result of a lack of excess capacity to deal with such risk and is precisely what risk management needs to be about – knowing how to manage events, no matter how improbable they may seem.

Creating and evolving contingency plans

When industries shifted to remote work due to COVID-19, the financial market had limited contingency plans to suit the scale of remote operations the global pandemic required. However, despite the unprecedented nature of the events, financial institutions were able to evolve their contingency plans and learn to work differently. This is, as mentioned Didier Valet, former Deputy CEO of Société Générale Group and current President of Xanthe Council, the result of technological tools they had at their disposal.

Having advanced solutions that enable instant augmentation of decisions is critical when routine communication is disrupted. These tools enable risk managers to make the right decision on time when faced with unprecedented and improbable risks and can help organizations rapidly adapt to critical changes.

Digitalization of risk management

The recent global events triggered a chain reaction in maritime and led to an instant increase in the need for digitalization solutions. According to Mark Fortnum, former bp executive and current Managing Partner at Stonefort Marine Consultancy, the reliance on physical inspections in maritime was perceived as absolute truth. When the global pandemic hit and remote work was mandated, the industry had to remove red lines and suddenly discovered that it was able to do so thanks to technology (and a little bit of common sense). The burden on ship staff and shipping companies was reduced by bringing together technological tools and maximizing collaborative efforts, thereby making inspections more efficient.

BIMCO’s head of contracts and clauses, Grant Hunter, noted that despite being around for decades and having the potential to save billions of dollars a year, only 1% of trades use electronic bills of lading. The reason is that e-bill processing requires collaboration across all maritime industry sectors, including bankers, legislators, stakeholders, and more. For widespread adoption of e-bills, everyone needs to accept that digitalization is the way forward and that technology is the way to do that. This past year showed the entire maritime ecosystem that e-bills are possible, and not only that – they are easier to manage and often safer than paper.

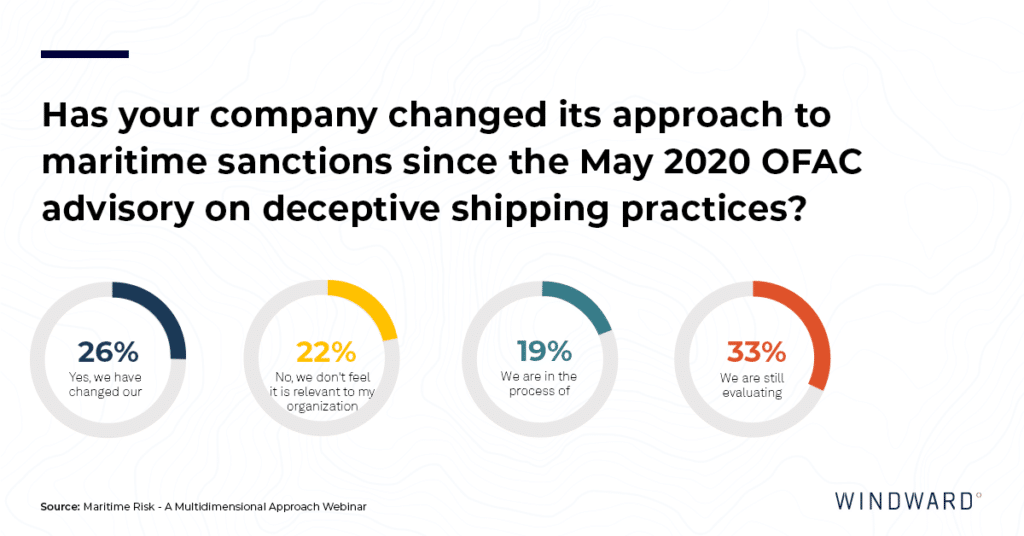

A new approach to risk for new regulations

The need to change the way risk is managed is especially critical in light of the latest OFAC and OFSI advisories. As the webinar touched on the new regulation subject, Ron asked participants whether or not their company has changed its approach to maritime risk as a result of the sanctions. Only 22% of the participants felt the sanctions had no impact on their operations. The fact that over 75% of the maritime community has changed, or is in the process of changing their approach to maritime sanctions, is incredibly significant, yet more so is the way the shift in approach is handled.

More and more businesses and organizations are leaning on each other, recognizing that failure to do so will result in multiple approaches that will increase vulnerability and ultimately harm the entire ecosystem.

Both from legal and financial perspectives, the new regulations change the face of maritime. As Julian Clark noted, he acted for P.B. tankers when they were placed on the OFAC list, and the entire company almost went down as a result. According to Clark, sanctions are less a legal issue and more like a “casualty scenario.” The financial, contractual, and reputational damage incurred by companies placed on the OFAC list forces them to change their approach to risk. For P.B. tankers, the use of technology would have streamlined the de-listing process and made it much easier to prove they did not violate sanctions.

Technology has a much more significant role in maritime than ever, and the new advisories have only raised the bar of expectation from a monitoring and risk perspective. As fraud is becoming more sophisticated, so must the methods maritime processionals take to avoid risk. AI and ML are just the start – a cross expertise view of risk based on innovative technology and true collaboration are key to changing risk management and meeting increased regulatory demands.

Technological Solutions such as Windward’s AI Platform have already helped organizations from a compliance perspective. As Mark Fortnum recalled, when a particular company wanted to collaborate, examining its entire fleet using the Windward system revealed that a small percentage was involved in deceptive shipping practices. As a result, the collaboration did not go through, effectively protecting their operation.

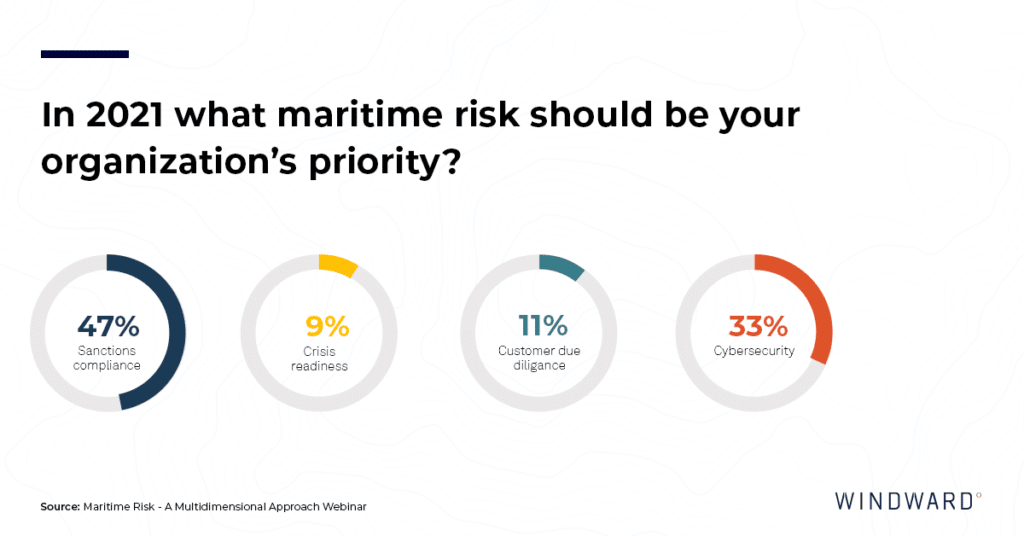

A key issue raised was the fact that increased reliance on technology can also increase cyber risk; however, in such instances, the right tools can still protect an organization, providing them with a better understanding of situations in real-time. This, like many other issues, must become industry-wide concerns and, therefore, must be handled at a large scale. As James Valentine said, “if you think you’re going to be able to assess risk and address it on your own, you’re going to lose.”

To wrap up the webinar, Ron asked participants what they think their organization’s top priority should be, and almost half said sanctions compliance. This solidifies the notion that the advisories are, in fact, the new floor, and the maritime community will be expected to do more in the future.

Q&A

- What could the IMO / Regulatory environment do better to help? What is your opinion on Maritime Single Window?

The IMO is more about the longer-term view of building globally safe and sustainable trade while supporting the Sustainable Development Goals. Regulators on a national level are responsible for deploying sanctions compliance. One thing that would be useful is a more expansive description of how ‘good actors’ may organize their operations to stay on the right side of expectations.

We didn’t discuss Single Window in the webinar- however, as a trade facilitation tool, it would lend itself very well to the electronic documents that Grant Hunter/BIMCO discussed. Having all relevant trade documents in one place makes a lot of sense to streamline global trade and mitigate counterparty risk. In essence, it brings transparency.

2. How are the lender’s underwriting vessel mortgages affected by OFAC sanctions? What changes in ship financing are taking place as a result?

This is a specialist area that deserves a much deeper explanation, but in essence, it comes down to screening for counterparty risk to map and understand exposure at scale.

3. Is there a maritime equivalent of IATA to streamline risk mitigation?

IATA is a trade association of airlines, shipping is much more dispersed into specialized trades, but BIMCO does a great job of being the voice of the industry and acting as an NGA at the UN/IMO.

4. Weaponization of sanctions (OFAC / FATCA and additionally the U.S. Committee on Foreign Investment in the U.S. (CFIUS) with stringent solid requirements in terms of political affiliation, KYC, and protection of critical assets. How would this affect the maritime industry, which can be considered as national security critical asset?

The maritime industry and, in particular, shipowners are on the front line of bearing the costs of this weaponization of sanctions approach that has been prevalent in the last couple of years. The effect is the increased cost of compliance and due diligence and the need for a technology approach to keep up with the rising complexity.